What are the Tax Advantages of a Solo 401(k) Plan?

You must have heard of the Solo 401(k) plan. And if you run a sole proprietorship business, it is very relevant to you.

What is a Solo 401(k) Plan?

A Solo 401(k) is a retirement saving plan designed for business owners with no employees. According to the IRS rules, you cannot contribute to a Solo 401(k) if you have full-time employees. However, you can cover yourself and your spouse with the plan.

Tax Advantages

One of the appealing factors of a Solo 401(k) plan is the remarkable tax benefits it entails.

With a Solo 401(k) plan, you can pick your tax advantage. You can choose the traditional 401(k), but the contributions will reduce your income. And the distributions in your retirement fund will be taxed as ordinary income.

The other option is the Roth Solo 401(k). It does not offer any initial tax-breaks but allows you to take distributions in retirement tax-free.

There are, however, merits in both the options. If you expect your income to go up in retirement, then opt for the Roth option. Likewise, if there are prospects of your income going down in retirement, then opt for a traditional 401(k) that allows you with tax-break today.

You can contact a Solo 401(k) provider to know all the tax benefits.

Covering Your Spouse Under Your Solo 401(k)

The good thing about the plan is that you can cover your spouse too in the Solo 401(k). But the necessary condition is that your spouse should earn income from your business. The facility enables you to contribute double the amount as a family. However, the contribution will depend on your income.

While your spouse can make elective deferrals as your employee, you as the employer can make the profit-sharing contribution for your spouse.

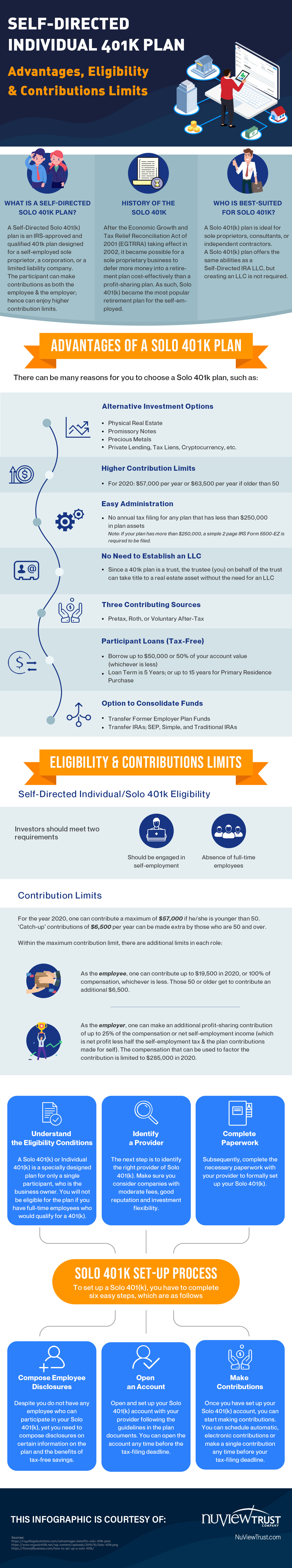

There are more benefits other than tax-advantages. Refer to the infographic in this post to know why you should open a Solo 401(k)